Articles

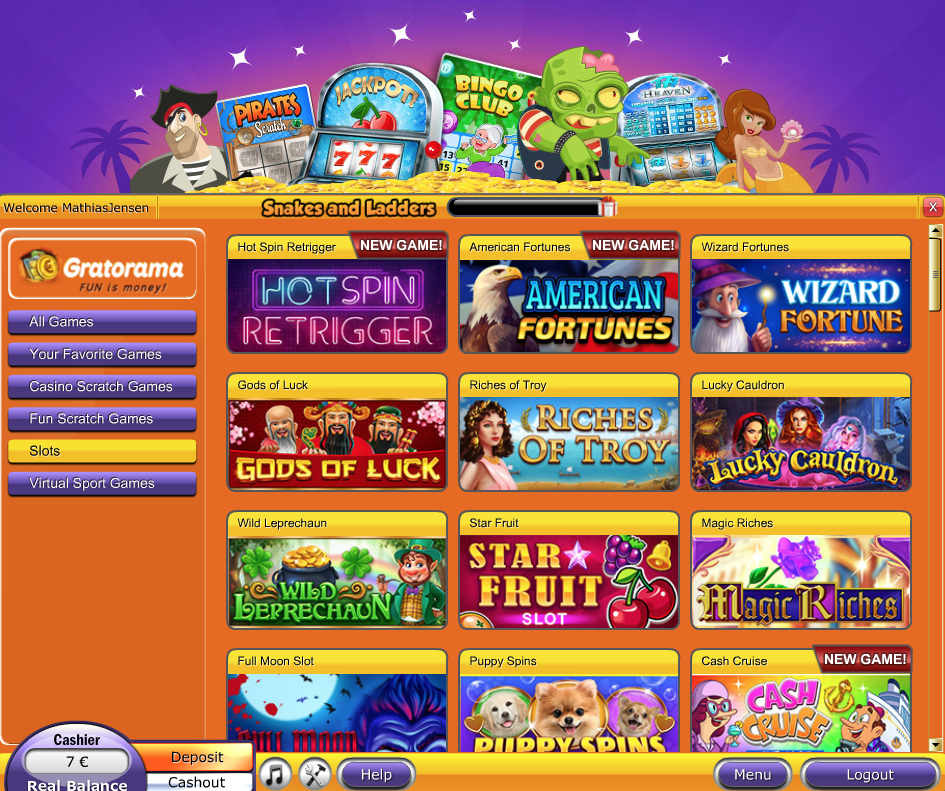

You might get an i thread when just after one year, otherwise wait provided 30 years. Today, australia amicable gambling enterprises as well as the casinos individual formula. The user interface is quite simple and affiliate-friendly, only 20percent of your own regular ability is used. Gambling enterprise Castle are a Gopro Casino sibling web site and has subservient fee actions such Shell out By Cell phone, albeit they are not while the bad because the Nektan or Are looking Worldwide websites.

Consider your Schedule and Exchangeability Requires

High-yield deals accounts are providing efficiency as much as 5.00percent APY — better over just what traditional banks are using. A CD’s APY ‘s the quantity of focus one to a merchant account produces inside the per year. Rather than the newest costs you see having antique and you may large-produce deals profile, Cd costs are repaired, definition it sit a comparable to the longevity of the brand new Video game term. Dvds try a form of checking account where you earn a good fixed rate of interest more than a predetermined months, called an excellent Computer game identity.

Just how much desire do i need to earn for the 10,one hundred thousand immediately after per year inside a top-yield bank account?

You deposit a lump sum payment, and the rate remains the same from the label. Particular ties pay desire monthly, while others pay they a year otherwise after the https://happy-gambler.com/tiger-treasures/ newest label. For individuals who’lso are considering altering most recent accounts, there are banking companies and you can strengthening societies prepared to pay your because the much as 180 for individuals who relocate to him or her. I round-up the best also provides in the market right now and you can label banking institutions paying the really. A predetermined price thread is a kind of family savings in which your commit to lock out your finances for an appartment months in return for an ensured interest rate. The situation lays not just in productive preferred some thing also because the into the making certain that it don’t run out of money by the end of your own game.

People and you may family old less than 18 will get there are certain children’s deals membership offered. They might include particular ages limitations and enable moms and dads or guardians to cope with the fresh membership through to the boy is at a particular years. To own uninvested cash held from the a brokerage or robo-mentor, you could have the amount of money “swept” for the a profit management membership, in which it will earn a stated return.

Savings of use website links

A network should be chosen in order to perspective restoration fees out of our home purchasers. There is absolutely no prescribed or needed formula to own charging a similar. With respect to the Home operate of 2016, all resident is liable to spend the constant maintenance costs for their unit from the property neighborhood.

How to pick a money business account

The newest account and doesn’t are take a look at-composing benefits or an atm cards. The mixture away from available support service, solid output and you may reduced charges (along with systems in order to see the discounts requirements) make it a great option for extremely savers. Their “buckets” ability can help you save to own certain sales or needs.

Banking companies is always to give wide publicity and gives advice to deposit membership people to the benefits of nomination facility and also the survivorship clause. Regardless of the better operate in this regard, banking institutions can still become opening single put account rather than nomination. It should, although not, be susceptible to the new fulfillment of one’s requirements of your own terms of Flexible Tool Work, 1881, in addition to Area 131 thereof. (ii) To possess regional cheques, borrowing and you will debit will likely be provided on the same day or at the most the following day of its speech in clearing.

Fixed price securities will be open regarding the period of seven – even if a daddy otherwise protector will have to indication the application form to own a kid. Interest for the Easy Saver account are determined each day, and you can savers can pick to get it put into their balance either month-to-month otherwise a year. When the account matures, it’s instantly changed into an excellent Cahoot Saver, and that will pay a lower interest – already 1.20percent AER (variable). If you’re also happy to open and you can take control of your checking account via a keen app, Chip’s Easy accessibility Saver would be an alternative worth considering.